One aspect which is very difficult for investors to account for is the risk of shock events overseas affecting their portfolios. In recent times, there has been the threat of conflict with North Korea and a major trade war between the US and China. In early June there was a short-lived risk of the Italian government defaulting on its debt as a result of leaving the Euro. Unlike the two other risks, markets essentially allowed this risk to be quantified at the time.

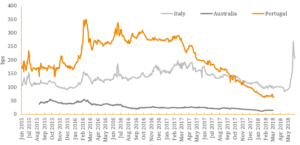

The chart below illustrates the 5 year credit default swap prices of Australia, Portugal and Italy showing the effects of the latest crisis. In simple terms, if the CDS price is at 300bps or 3% per year, that will be a premium of 15% paid over 5 years (5 * 3%) and if recoveries on defaulted sovereign bonds are assumed to be 40c/$, then the implied loss given default is 60%. Put simplistically, this implies a risk of default of 1 in 4 or a 25% risk of default over the next 5 years.

Source: Bloomberg

The collapse of the EUR, which would likely be precipitated by an Italian exit or default, would most likely be a significant event for global markets and cause a severe widening in credit spreads. It is for this reason Amicus encourages significant liquidity buffers in our client portfolios and we advise hold to maturity strategy rather than trading, which significantly reduces risks in portfolios.