Defying opinion polls and betting markets, the Liberal-National Coalition won an outright majority at the Federal elections over the weekend. The stock market rose by 1.7% with the surge driven by gains in the financial sector and private health insurers as the Coalition’s policies are perceived to be more pro-business and overall uncertainty over many policies, including negative gearing, capital gains tax and surplus franking credits, have now been removed (at least until the next election).

The LNP “presidential” style campaign focused on Scott Morrison as an individual and his “miracle” victory gives the Prime Minister a huge personal mandate. Since the Coalition did not make many additional promises during their election campaign beyond what was outlined in the pre-election budget, Mr Morrison starts with a largely clean slate. However, it is unclear how he intends to execute his mandate and where he will focus his efforts.

One of the few economic policies announced during the election campaign was a new $500 million First Home Loan Deposit Scheme for first homebuyers, which provides 10,000 first homebuyers the opportunity to buy a home with only a 5% deposit (rather than the standard 20%) allowing them to enter the housing market earlier without the need for lender’s mortgage insurance.

The major banks’ share prices rose between 6% and 9% on Monday. The majority of these gains can be attributed to the removal of the threat not to rebate franking credits, but other policies such as the protection of negative gearing, capital gains tax concessions and help for first home buyers indicate the Morrison government has policies likely to be conducive to supporting house prices which in turn will be positive for bank share prices, both in terms of increased lending opportunities in a market with higher activity but also potentially lower loan losses if house prices stabilise or rise.

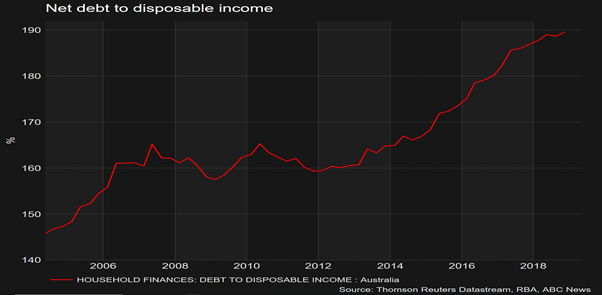

However, the other side of the ledger is household debt is still rising as per the chart below and all previous commentary from RBA Board Member Phillip Lowe, before he assumed his current role as Governor, was his primary concern was household debt levels and the effects of a housing price collapse on the economy. This potentially militates against an interest rate cut if the RBA believes this could lead to another debt-fuelled acceleration in house prices. As we have previously argued unless household debt falls, there is a clear and present threat to the Australian economy as economic growth dependent on increasing debt levels is not sustainable in the medium or longer term.

In contrast, Dr Lowe explicitly stated in his latest speech the RBA Board will be considering reducing interest rates at its June meeting following the release of the unemployment figures earlier this month which the RBA had previously said were the key to any future interest rate decision. These figures while mixed, had unemployment rising to 5.2% due to a greater participation rate. Dr Lowe said in his Brisbane speech “A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target” which in the context of the unemployment rate having just risen was widely interpreted as signalling a rate cut is likely to be announced at the board’s June meeting.

Amicus’ assessment is if the RBA decides to cut interest rates at its June meeting it will be a sign the Australian economy is much weaker than the RBA previously believed and the new Morrison government will be facing some very difficult economic challenges over the next three years.